|

Forecasting

Ability of a Periodic Component Extracted from Large-Cap Index Time Series, M.J. O’Shea, Journal of Forecasting, M. J.

O’Shea, 5 April 2016 (2016)

The ‘Sell in May and buy at

Halloween’ adage has been around for many years and quoted by stock market

pundits. If there is any truth to

this adage, then there must be a periodic component embedded in the price

of indices. A visual inspection

indicates that large cap indices have stochastic (noisy) and other

non-periodic contributions. If such

a periodic contribution is present it is hidden in these much larger

contributions. It’s important to

note that this contribution does not have to be perfectly periodic – it can

have variations in period and variations in amplitude. Two properties of this quasi-periodic

component must be present:

·

it’s repeat time must vary about a certain average value with the

variations about the average period being significantly smaller than this average

period

· the variations in amplitude must not

average to zero.

It

is very difficult to use standard methods such as Fourier/spectral analysis

to extract such a component. In

general, it is not possible to uniquely separate such a quasi-periodic

component from these other contributions mathematically. It is however possible to determine the

average contribution of this quasi-periodic term. This can be done by folding the time

series to average out the large non-periodic contributions leaving behind

the average of the quasi-periodic contribution. This folding leads to a so-called

repetition function.

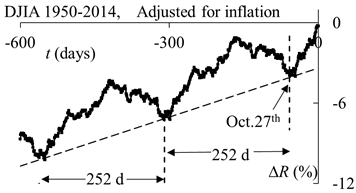

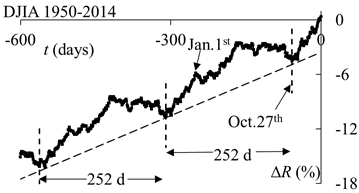

This repetition function is

shown above for the Dow Jones Industrial Average. A clear periodicity is

present with a maximum in May/June and a minimum in October. Scaling the Dow Jones Industrial Average

with the cost of living index removes some of the gradient but the averaged

periodic term is still present. We

looked at eight large cap indices and similar periodic terms were present

in six of them.

It’s important to note that the

presence of a quasi-periodic term does not mean that an investor can take

advantage of it. To see if this

average periodic term has any predictive power out-of-sample tests were

done and indicate some limited predictive power for each of the indices

exhibiting a quasi-periodic term.

Caution: None of this is

investment advice; it is simply work looking at the predictive power of a

quasi-periodic term extracted from a time series.

To give insight into the

method, test data was generated and analyzed here using

this method. This folding method, the autocorrelation

function method and spectral/Fourier Analysis are compared.

The effect of outliers is

considered here.

Finally the repetition

functions of all the DJIA components are given here.

|