|

Forecasting ability of a periodic component extracted from

large-cap index time series-Comparison of the repetition function method of

finding a periodicity with two other methods using test data. M. J. O’Shea, Jour. Forecasting

To

illustrate the repetition function method and compare to the

autocorrelation function and spectral density methods we created three

price time series using the business days from Jan. 2nd 1930 –

Jan. 2nd 2015.

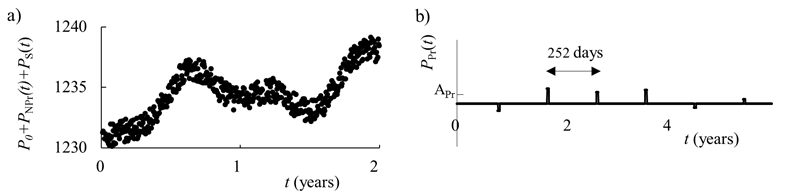

A1.1 Generating the test time series

Three

test time series are generated. Each time series P(t) is

made up of a constant term P0, a non-periodic term PNPr(t)

increasing at approximately 7 price units per year, a stochastic term PS(t)

of average amplitude AS = 2 price units and a periodic

term PPr(t) who’s average amplitude is different

for each of the three series. Figure A1(a) shows a section of the test

time series consisting of the sum of the first three terms only.

The

periodic term, PPr(t) is chosen to be a narrow

rectangular pulse of width 10 days. To keep the test data as general as

possible the amplitude of the pulse is varied at random and allowed to be

negative but with an average (positive) amplitude APr as

illustrated in Figure A1(b). The midpoint of the pulse is placed as close

as possible to the arbitrarily selected 8th day of November of

each year. Thus it is not precisely periodic since the length of a year

varies by a few days from year to year. Its periodicity averages to 252

business days. The average amplitude, APr, of the

periodic term (chosen to be much smaller than the change in the

non-periodic term over one year) is 2.0, 1.0 or 0.4 price units for the

three series so that the ratio APr/AS

for the three test series is 1.0, 0.5 and 0.2.

A1.2. The autocorrelation method

The

autocorrelation method can be used to infer if a periodicity is present in

a time series. It is convenient to differentiate P(t) to

remove most of the effect of the non-periodic background. Since the

Figure

A1. The generated test data. a) A two-year section of the generated

85-year test time series consisting of a constant P0, a

non-periodic term PNPr(t), and a stochastic term PS(t)

of amplitude AS of 2 units. b) A 6-year section of the approximately

periodic part of the time series, PPr(t), of average

period 252 business days (1 year) with average amplitude APr.

The test data of a) are combined with the test data of b) (with three

different amplitudes APr = 2.0, 1.0 or 0.4 price units) to

make the three test data time series.

data is noisy, it must be

smoothed prior to differentiating. Several different combinations of

smoothing and differentiating were tried and it was found that a

straightforward five-point smooth before differentiating worked best. j(t) is then

calculated from the change in adjusted closing price per day, dP(t)/dt

:

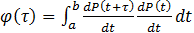

(A1) (A1)

Figure

A2. The autocorrelation function for the three sets of test data. Arrows

indicate a time of ± 252 days. No autocorrelation peak is present for

the case APr/AS = 0.2.

This

calculated correlation function is shown in Figure A2 for each of the three-time

series. A large sharp self-correlation peak is centered att = 0 and decays away to a background value of

approximately  for t ≠

0. An autocorrelation peak is present at t = ± 252 days as

indicated by the arrows for the case of APr/AS

= 1.0. When the amplitude of the periodic term is reduced (APr/AS

= 0.5) the correlation peaks are just vanishing into the background noise

in f(t) and for

the smallest amplitude (APr/AS = 0.2)

no correlation peak is visible. for t ≠

0. An autocorrelation peak is present at t = ± 252 days as

indicated by the arrows for the case of APr/AS

= 1.0. When the amplitude of the periodic term is reduced (APr/AS

= 0.5) the correlation peaks are just vanishing into the background noise

in f(t) and for

the smallest amplitude (APr/AS = 0.2)

no correlation peak is visible.

A1.3. Fourier analysis and the spectral density

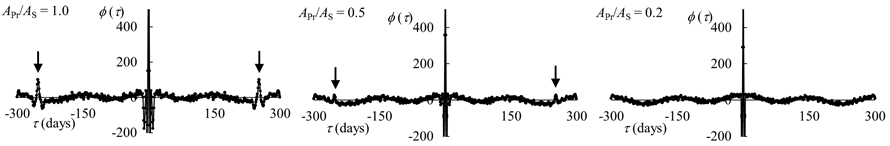

Any time-series  that is of the form of a periodic function can be

represented by a sum of components in the form of sines and cosines or by a

sine function with a phase shift that is of the form of a periodic function can be

represented by a sum of components in the form of sines and cosines or by a

sine function with a phase shift  : :

, ,

provided

that  is reasonably well behaved.

If the mean value of the time series is zero then a0 =

0. The sum over frequency w is usually

the sum over a fundamental frequency w0 and harmonics 2w0 , 3w0 etc. In our test data the fundamental frequency

of the periodic component corresponds to a period T0 of

252 business days and the phase is also known. Using w = 2p/T and with the change of notation aw ® aT,

the coefficient aT is given by: is reasonably well behaved.

If the mean value of the time series is zero then a0 =

0. The sum over frequency w is usually

the sum over a fundamental frequency w0 and harmonics 2w0 , 3w0 etc. In our test data the fundamental frequency

of the periodic component corresponds to a period T0 of

252 business days and the phase is also known. Using w = 2p/T and with the change of notation aw ® aT,

the coefficient aT is given by:

. .

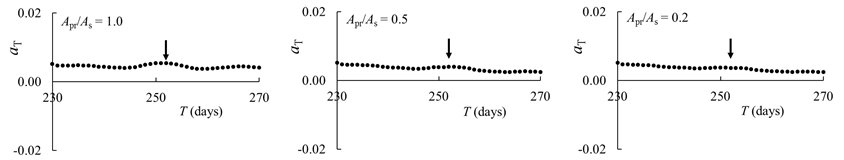

This

is the spectral density and yields the amplitudes of periodic terms that

contribute to the time series. In practice the integral is done over many

periods, T. The price time series  was scaled so that if the only term present in

the time series was was scaled so that if the only term present in

the time series was  , then , then  would be 1. We performed this analysis on our

test data of the previous section and would be 1. We performed this analysis on our

test data of the previous section and  vs T for these time series are shown in

Figure A3. In these plots we varied the period T about the known

value of 252 days and a small peak connected vs T for these time series are shown in

Figure A3. In these plots we varied the period T about the known

value of 252 days and a small peak connected

Figure

A3. The coefficient  versus period T for our test data. Arrows

indicate the expected position of a component (peak) signifying a

periodicity of 252 days. No peak is present for the case APr/AS

= 0.2. versus period T for our test data. Arrows

indicate the expected position of a component (peak) signifying a

periodicity of 252 days. No peak is present for the case APr/AS

= 0.2.

with

a periodicity of 252 days is found for our test time series with the

largest periodic contribution

(Apr/AS

= 1.0). As the periodic contribution to the time series decreases this

peak gradually vanishes. The reasons these peaks are small is a combination

of:

·

the periodic

term only contributes a small amount (approximately 4%) to the magnitude

of the time series, most of the time series magnitude comes from large

stochastic and other non-periodic contributions.

·

the amplitude

of the periodic term varies from year to year.

·

the exact

period varies slightly from year to year since different years have

different numbers of business days.

Several

modifications of this analysis were tried including various types of data

smoothing and none proved successful in identifying a periodic component

for Apr/AS = 0.2.

In

addition to the above problems a second harmonic contribution (at T

of 126 days) was not detectable. For the spectral analysis method to

reveal the shape of the periodic term, we would need to detect the peak

associated with the fundamental period and several of its harmonics to

reconstruct the periodic contribution to this time series and this does not

prove to be possible.

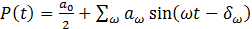

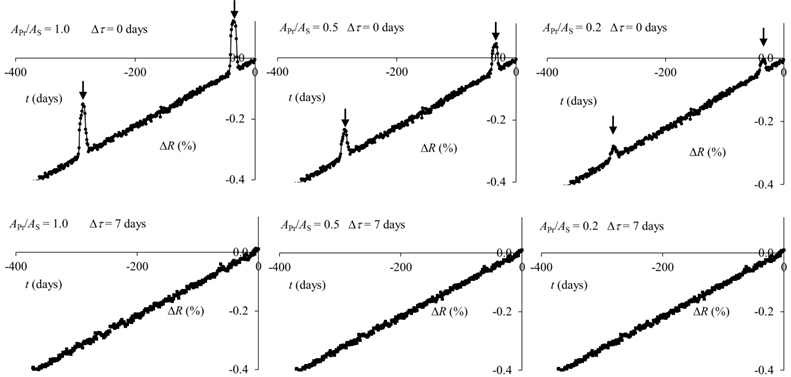

A1.4. The repetition function method

This section should be read along with Section 2

of our paper. To calculate the repetition function we take the tk to

be the first business day of each year and it is convenient to measure t

and tk from

an origin of Jan. 2nd 2015 so that t1 = 0,

t2 =

252, t3 =

504, t4 =

754 days etc. Construction of the repetition function via equation (5)

significantly reduces any stochastic contribution from the time series. It

also averages over any non-periodic variation in the time series to produce

a linear term. The repetition function for each of the three-time series

is shown in the top three plots of Figure A4. The percent change in  , i.e. , i.e.

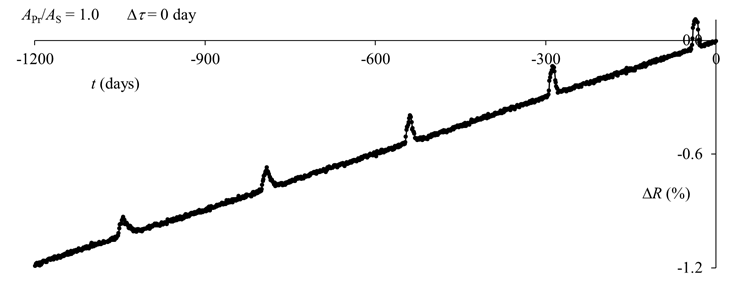

Figure

A4. The repetition function for the three sets of test data. The tk of

equation (5) are set to the first business day of each year. Repetition

functions are shown for test data with APr/AS

= 1.0, 0.5 1oise (S/N) ratio of of the

background. or of y is more apparent in the repetition function sinc ethe

sting that the presencand 0.2, and Dt is set

equal to zero days or seven days as indicated. The arrows are spaced by

252 days and the presence of the indicated peaks (upper plots) show that a

periodicity is detectable for all three test data series. When Dt is not zero (lower plots) the periodicities

vanish for all three test series as expected.

, is plotted. The periodic signal is easily found

for each of the time series and indicates the repetition function is more

sensitive than the autocorrelation function or spectral density method in

finding periodicities and reconstructing this component. The overall

linear increase of the background in the repetition function results from

the long-term uptrend in our test data. The position of the periodic

signal in the repetition function is found to be Nov. 8th as

expected. , is plotted. The periodic signal is easily found

for each of the time series and indicates the repetition function is more

sensitive than the autocorrelation function or spectral density method in

finding periodicities and reconstructing this component. The overall

linear increase of the background in the repetition function results from

the long-term uptrend in our test data. The position of the periodic

signal in the repetition function is found to be Nov. 8th as

expected.

If the period is not chosen to be a periodicity

that is present in the price function, P(t), then the

repetition function should yield only linear and stochastic terms along

with a constant background. Thus when a periodicity is found, it should be

possible to change that periodicity by a small amount Dt , see equation (5), so that the repetition

function no longer has a periodic component. This serves as a check on

this method. The repetition function with Dt set to 7

days is shown in the lower plots of Figure A4 for our three sets of test

data. A periodic component is no longer present as expected.

While

the first time period in the repetition function, i.e. the first 252 days,

has complete overlap allowing signals to add up, this will not happen for

time periods further from the origin since the term PPr(t)

is not exactly periodic. Thus sharp signals close to the origin will be

superimposed by the

Figure

A5. The repetition function over an extended time range. The tk of

equation (5) are set equal to the first business day of each year. The

amplitude of the peak is gradually reduced for peaks further from the

origin due to the fact that the test data is not exactly periodic in time.

repetition function and

add coherently while sharp signals further from the origin may not add

coherently. This effect can be seen in the repetition function of Figure

A5 for APr/AS = 1.0 plotted over an

extended time range. The maxima further from t = 0 are reduced in

amplitude with a reduction of about 10 percent per maxima.

In

conclusion the repetition function is more likely than the autocorrelation

method or the spectral density method to reveal a periodicity provided one

knows the particular periodicity to search for. This is due to the

reduction in the stochastic contribution and the averaging of non-periodic

variations over many time periods as the repetition function is constructed

via the summation in equation (5).

|