|

Forecasting

ability of a periodic component extracted from large-cap index time series

- Effect of outliers on the repetition function. M. J. O’Shea, Jour.

Forecasting

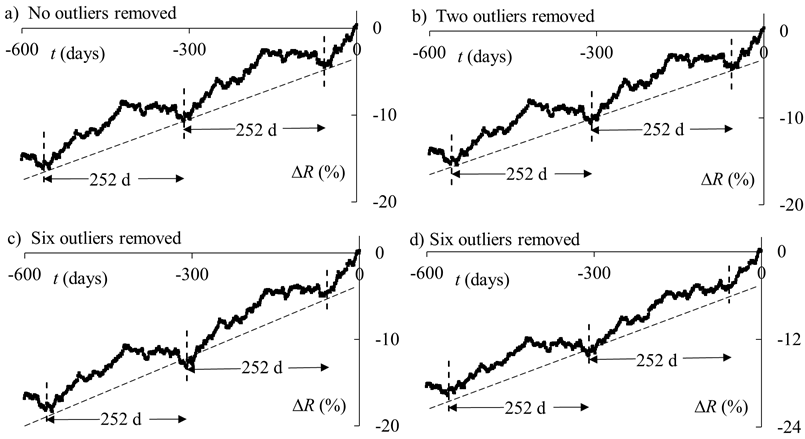

We present further details of our checks (the

third check of section 2 of our paper) for possible outlier influence on

the observed periodic term in the repetition function for the DJIA.

Initially we removed the years 1987 and 1998 which

contain the October 1987 crash in equities and the August 1998 collapse of

Long-Term Capital Management which Maberly and

Pierce (2004) suggested as a cause of the calendar anomaly. This is done by removing the

appropriate tk in Eq. (5). The repetition function for this case is

shown in FigureA6(b) and there is no significant change as compared to

Figure A6 (a) where we re-produce the original repetition function with no

years removed.

To identify outliers in a more systematic way we

removed years that had the largest change (increase or decrease) in the

DJIA in the range 1950 to 2014 by removing them from the sum in equation

(5). We choose to remove the years

associated with the three largest positive and the three largest negative

changes. This repetition function is shown in

Figure A6(c) and the periodic pattern is intact and similar to Figure

A6(a). Thus outliers as defined

above do not play a major role in producing this periodicity.

Figure A6. The repetition function for the DJIA

index (1950-2014) for selected circumstances. The tk of

equation (5) are set equal to the first business day of each year. a) The repetition function for the

time-span 1950-2014. b) Two outlier

years (1987, 1998) are removed, c) six outlier years (1954, 1958,

1966, 1974, 1975, 2008) are removed,

d) six outlier years (1987, 1989, 1997, 2001, 2002, 2008) are

removed from the sum in equation (5).

The vertical dashed lines indicate the yearly minima and the sloping

dashed lines are the trend lines, third term of equation (3).

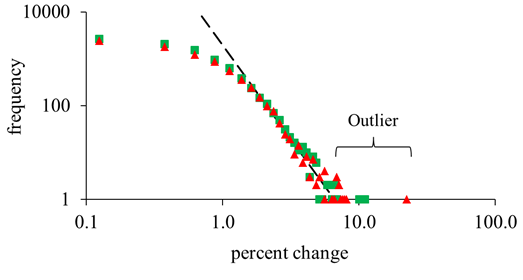

To test the robustness of the hypothesis that

outliers do not play a major role in producing the periodic term we define

outliers in an alternative way. The

distribution of percent changes in the form of a probability density

function (PDF) is first determined.

We have performed this analysis for three cases: looking at the

frequency of percent changes over one day, one month, and three months. As other workers have already shown (Gopikrishnan et al., 1998) we find that

each of these PDF’s is not a normal distribution and so deviations from a

normal distribution cannot be used to identify outliers. Plotting the PDF on a logarithmic scale

reveals approximate power law behavior of the tails as seen by other

workers (Gopikrishnan et al., 1998; Pan and Sinha,

2007; Mu and Zhou, 2010). For

the largest percent increases and decreases each of these PDF’s show some

deviation from a smooth curve. An

example for the case of the PDF for one-day changes is shown in Figure A7

and the largest deviations occur for price changes greater than or equal to

6.9 %. Thus we define all years that

contain a day where the change in price (increase or decrease) is greater

than or equal to 6.9 % to be outliers and these are indicated by the

labeled bracket.

These years are removed from the summation of equation (5) by removing the appropriate tk. Figure A6(d) shows the repetition function after removal of these

outlier years. The periodic term is

intact though somewhat reduced indicating these outliers are not the only

years that play a role in producing this pattern.

Figure A7. The

frequency of percent changes for a time interval of a day for the DJIA

index for the time-span 1950-2014. The increments of change in price are

one quarter percent and the plot is in a log-log form. The green squares are price increases and

the red triangles are price decreases.

Power law behavior is observed for large % changes as indicated by

the dashed line.

Gopikrishnan P, Meyer M, Amaral LAN, Stanley HE. 1998. Inverse cubic

law for the distribution of stock price variations. Eur. Phys.

Jour. B3, 139-140.

Maberly ED, Pierce RM. 2004. Stock

Market Efficiency Withstands another Challenge: Solving the “Sell in May/Buy

after Halloween” Puzzle. Econ Journal Watch 1, 29-46.

Mu G-H, Zhou W-X. 2010. Tests of Nonuniversality of the Stock Return Distributions in an

Emerging Market. Phys. Rev. E 82,

066103. http://dx.doi.org/10.1103/PhysRevE.82.066103

Pan RK, Sinha S. 2007. Self-Organization of Price Fluctuation

Distribution in Evolving Markets. Europhys. Lett.

77, 58004. doi:

10.1209/0295-5075/77/58004

Outlier

years identified in the range 1950-2014 using this alternative definition

are: 1987, 1989, 1997, 2001, 2002, 2008.

|